Local Media Crisis 1/2: Causes & Impacts of digitization

Local media are going through a deep crisis, exacerbated by the rise of digital technology and the domination of tech giants like the GAFAM. For several years, the industry has been trying to raise awareness among stakeholders about these issues, which severely affect the viability of Quebec and Canadian media.

Traditional Media Digitalization

Our medias are transforming.

Today, content from conventional radio (on a traditional receiver) is migrating to streaming radio, and the offerings in digital audio, podcasts, and streaming music are increasing.

News media are increasingly abandoning paper to develop their own platforms.

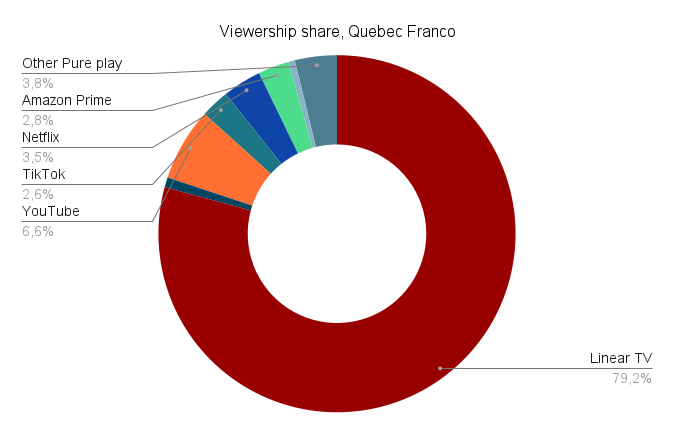

Linear television is increasingly being viewed via Over-The-Top (OTT) services, that is, the broadcasting of linear television content over the Internet and video on demand (streaming services).

We can also observe this phenomenon with outdoor advertising, whose digital inventory is increasing and is now being purchased via online programmatic platforms.

Impacts on media revenues

Despite this shift, Quebec local media, both online and offline, have seen their advertising revenues drop by 41% since the last peak reached in 2012. Meanwhile, those of other digital platforms have recorded a record increase of 629%, according to the Media Study Center (CEM).

Percentage variation in advertising revenues by sector in Quebec from 2012 to 2022

Source: Centre d’Études sur les Médias, Université Laval

In 2023 alone, we witnessed the disappearance of Vrak TV, Métromédia, which includes 16 local newspapers in the Montreal area, and the 70 community newspapers of the Metroland Media group in Ontario. More than 3,500 jobs have been cut in Canadian media.

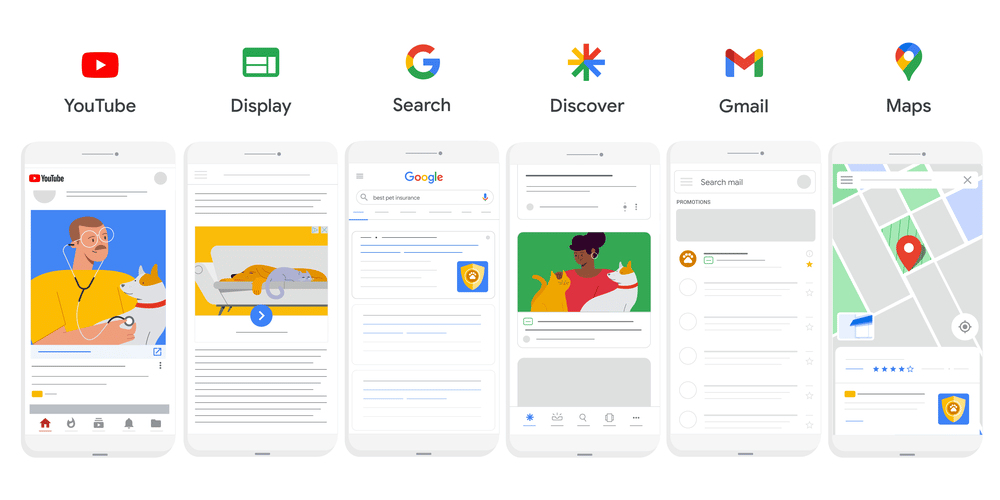

According to Statista, nationally, in 2022, more than 46% of digital investments were dedicated to paid search and 25% to social networks. The rest is divided between display, video, and digital signage.

Causes of the exodus of advertising investments related to digital technology

The diversification of digital offerings

Several factors contribute to this exodus of advertising investments. First, increasing competition due to the diversification of channels and platforms available for consuming online content.

Since the creation of Facebook, platforms like Threads, Instagram, X, TikTok, Twitch, Snapchat, BeReal, Pinterest, Reddit, and YouTube have emerged. According to Vividata, the average user consults 7.2 social networks per month.

This fragmentation of offerings inevitably leads to changes in media consumption habits.

The CEM 2024 Digital News Report shows that a quarter of Canadians identify social networks as their main source of information.

The challenges posed by Bill C-18 and its consequences

We can also highlight poorly adapted government legislative support, as evidenced by the impacts of Bill C-18, which aimed to compensate local media for the use of their content. This law was circumvented by META by blocking Canadian news content.

Many local media are now deprived of an essential source of distribution and discoverability for their content. This is the case, for example, for RAD of Radio-Canada, Urbania, and Narcity.

Compte Instagram de RAD de Radio-Canada

The prioritization of instant results

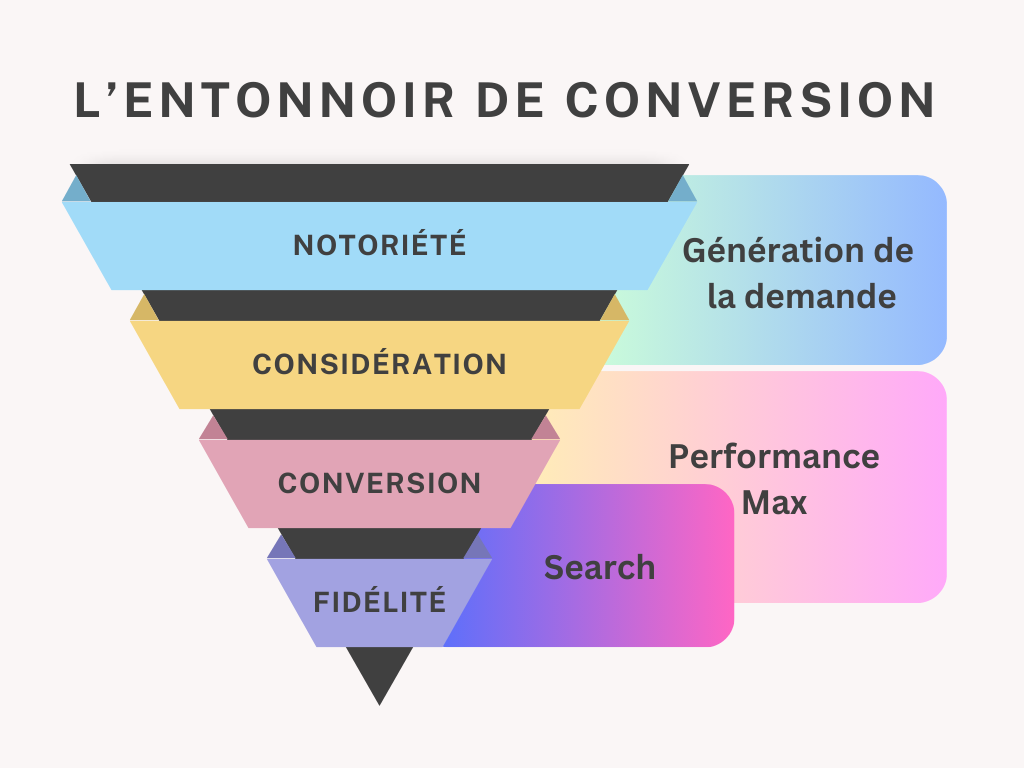

We must acknowledge that companies prioritize short-term, even instant, return on investment. This is even more true given the current economic situation. The combination of large user bases and excessive advertising proposals means they benefit from a very large advertising inventory.

These low costs allow them to sell advertising visibility based on instantly generated results such as website visits, purchases, return on investment, etc. These tactics are called PPC (pay-per-click).

CONCLUSION

The impact of digitization on local media is undeniable: it has weakened our traditional economic models, but it has also opened the door to new dynamics.

The transition to digital requires local media to innovate, rethink their relationship with their audience, and diversify their revenue sources.

This transformation also brings opportunities: primary data, contextual environments, measurement, attribution, real-time advertising performance optimization, and CPM buying.

Far from signaling their decline, digitization could well be the engine of a renewal – provided they manage to adapt and take advantage of new technologies.

You can learn more by downloading our white paper on media trends 2025 here.

Contact us to discuss your marketing investments.